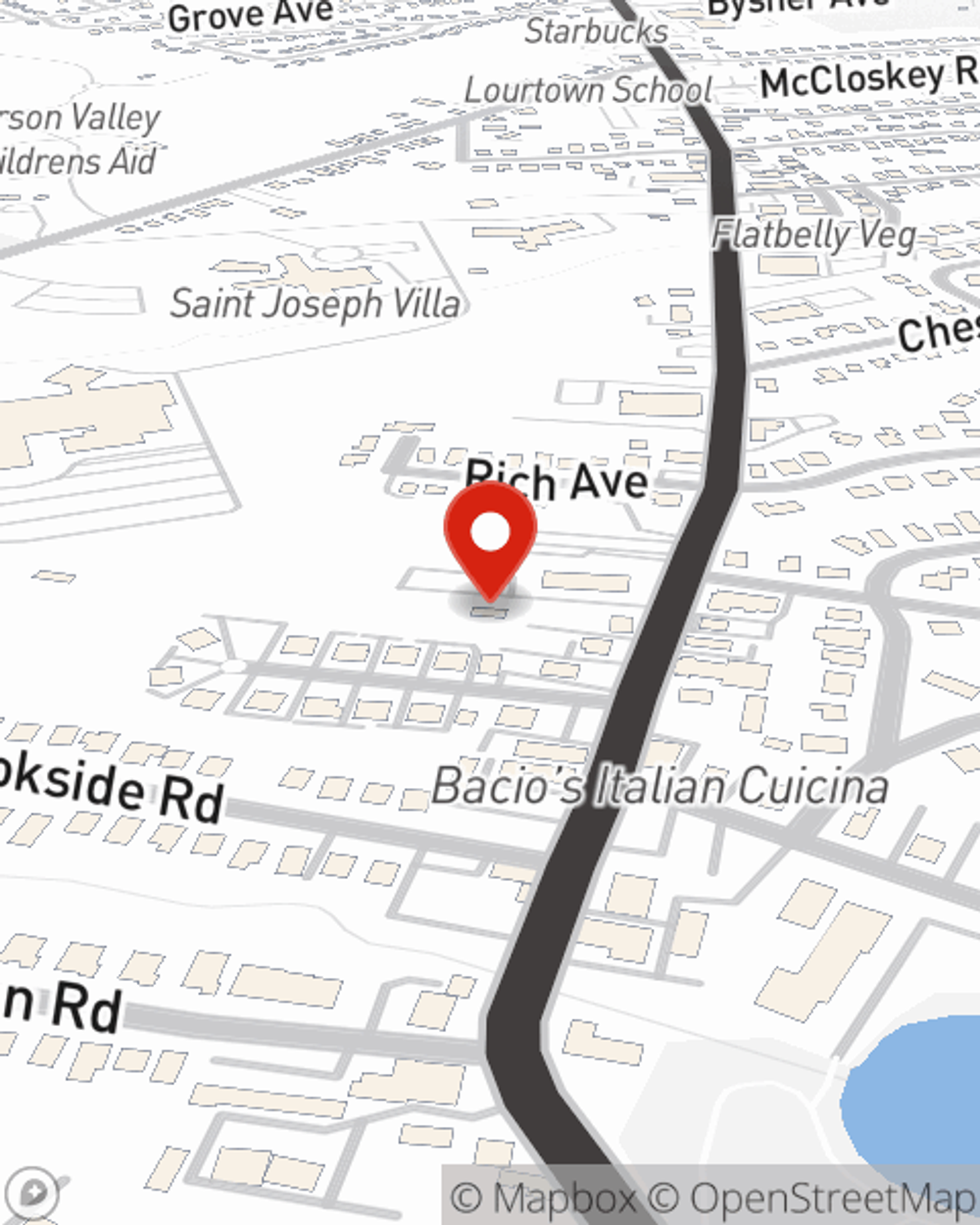

Business Insurance in and around Erdenheim

Looking for small business insurance coverage?

No funny business here

- Montgomery County

- Chester County

- Bucks County

- Philadelphia County

- Delaware County

Cost Effective Insurance For Your Business.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, retailers, contractors and more!

Looking for small business insurance coverage?

No funny business here

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, worker’s compensation or builders risk insurance.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Chris McNulty's team to learn about the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Chris McNulty

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.